- YourGovernment

-

OurCommunity

-

- About Tualatin Advisory Committees Animal Services Community Involvement City Codes City Council City Projects

- Community Crime Reports Customer Service Request Explore Tualatin Now Fire Library Municipal Court Tualatin Today

- Parks & Recreation Passports Permits & Forms Planning & Zoning Police Volunteer Tualatin Moving Forward

-

-

ForVisitors

-

- Parks, Greenways, Recreation and Library Library Parks Public Art Parks and Recreation

- Shopping, Dining, and Entertainment Chamber of Commerce

- Community Events Community Theatre Pumpkin Regatta Special Events

-

- DoingBusiness

-

HowDo I?

-

- Apply for a Job Apply for an Advisory Committee Contact the City Council Get a Copy of a Police Report File a Records Request Find Forms

- Find Planning & Zoning Find Public Transportation Find the City Code Get a Business License Get Email Subscriptions/Notifications Locate City Offices

- Contact the City Pay My Traffic Fine Pay My Water Bill Reserve a Facility Sign Up for a Recreation Program Search the Website Volunteer

-

Council Building Financial Impacts

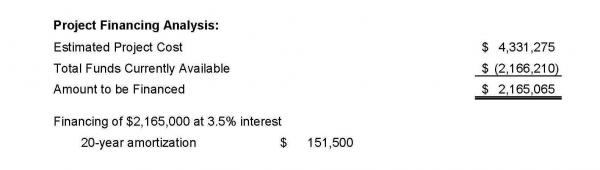

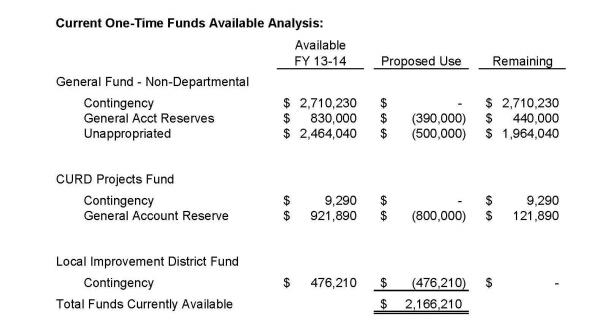

If a building is constructed, it will require a decision on how the building should be financed. Analysis has been completed on what funds are available and if the City can afford a new facility. Depending on the size and cost of a new building, a vote for a General Obligation Bond may be required.

Tualatin's Five Year Financial Model

The City utilizes a fiscal health model to forecast future financial stability. The model separates on-going, stable revenue sources from one-time, fluctuating revenues. During the budget process, the City matches consistent, on-going expenditures to the on-going revenues and plan one-time expenditures from available one-time revenues. For five-year projections, the City employs conservative estimates of both revenues and expenditures, understanding that the assumptions built into the model are likely to change the further out the model goes. The model gives Council and staff the opportunity to recognize potential gaps and begin discussions about ways to minimize the impact before it hits.

During the FY 13-14 budget process, a budgetary gap was discussed, but the gap was removed after the budget process with legislative changes to the Public Employee Retirement System (PERS) and the PERS Board’s reduction of the City’s contribution rate. Current projections in the fiscal health model show a positive on-going alignment through FY 14-15. Staff will continue to refine the assumptions in the model, as well as potential further changes to PERS, in hopes of maintaining a positive alignment beyond FY14-15.

The potential funding plan for a Council Building replacement does not impact the fiscal health model, as the proposal utilizes currently budgeted expenditures for the Seneca Building lease, as well as off-setting revenues into the General Fund from other City funds that pay for General Fund services.

Cost for a 10,000 Square Foot Replacement Building

One-Time Funds Available for Use

What is the Transportation Development Tax

In 2008, Washington County voters approved a measure to implement the Transportation Development Tax (TDT), a charge on developers of new residential, commercial, and other projects within all cities and unincorporated areas of Washington County. To learning more about how the amount is determined, what the revenue is used for and other related information, visit the Transportation Development Tax page.